Best Prop Trading Firms

Proprietary or prop trading is an increasingly popular investment method, and plenty of firms are joining this rising sector of the industry. In this form of trading, financial firms profit from market activity, rather than commissions on client trades. If you can trade successfully and follow market trends, these companies will speed up your journey toward financial independence.

Traders on prop platforms trade in cryptocurrencies, fiat currencies, stocks, bonds, commodities, and other financial instruments. Finding a platform that deals in assets that are up your alley, under conditions that suit you, can be challenging. To help out, we’ve compiled a list of best prop trading firms for you to choose from.

Top Proprietary Trading Firms for October 2023

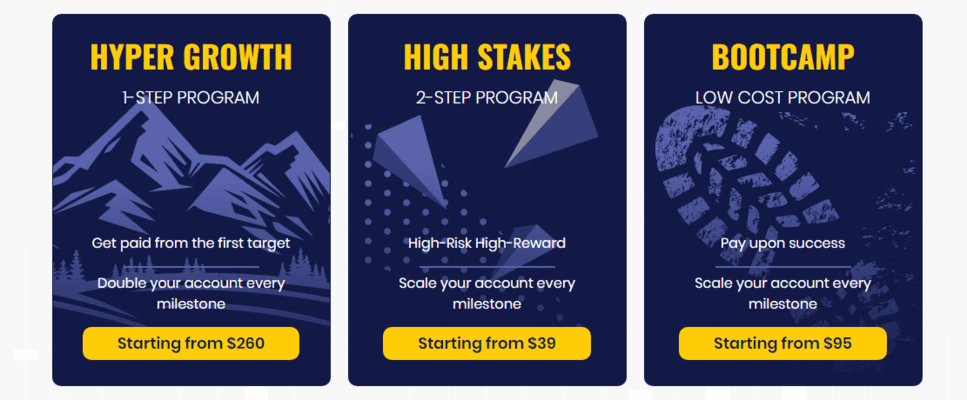

The 5%ers

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

The 5%ers

- Several account models

- Instant funding

- Rich selection of trading tools

- Monthly salary

- Bonuses

- Faster scaling plan in the industry

- Unlimited time on all programs

Topstep

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

Topstep

- Futures trading

- Digital coaching

- Buying power up to $150,000 for futures

Fidelcrest

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

Fidelcrest

- Traders get up to 90% of profits

- $15,000 initial capital

- No monhtly fees

FTMO

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

FTMO

- 90:10 payout ratio

- Free mobile app

- Unlimited trading period

FundedNext

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

FundedNext

- 15% profit share from the start

- High profit split

- An account manager for every trader

- Relaxed trading rules

FX2 Funding

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

FX2 Funding

- One-stage evaluation

- No time limits

- No stop loss required

- Doesn't require credit checks or collateral

The Trading Pit

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

The Trading Pit

- Four tools and four platforms supported

- Up to $320,000 payout for CFD trading

- Progressive payout increase

- No hidden fees

- Low latency and transactional costs

- FREE trading platforms

- No time boundaries

- In-depth mentorship and educational support

- Cross-platform compatibility

Darwinex Zero

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

Darwinex Zero

- No limitation rules (no min/max drawdown - no max loss)

- Monthly capital allocation (even in negative months)

- Available to traders worldwide

- External investor funding

Funding Traders

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

Funding Traders

- 25% growth scaling plan every 3 months

- Knowledge hub and community support

- Account merging allowed

- Permits news trading

- Unlimited trading period

SurgeTrader

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

SurgeTrader

- Quick processing times

- Several pricing tiers

- Diverse selection of trading securities

Trade The Pool

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

Trade The Pool

- First specialized stock trading prop firm

- 1-step evaluation

- One-time fee

- Over 12,000 symbols to trade with

- Allows shorting penny stocks

Liberty Market Investment

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

Liberty Market Investment

- 100% profit on the first $30,000

- No registration fees

- Wide selection of futures exchanges

- Low starting subscription price

City Traders Imperium

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

City Traders Imperium

- Free course before enrolling in the Evaluation program

- Well-known for trading forex pairs

- Online material for traders

TradersWithEdge

Fortunly's Rating: Our editorial team determines the rating based on a set of evaluation criteria developed for each product and service category.

TradersWithEdge

- Three account types: Turtle, Hare, and Instant

- Android and iOS app available

- Active community

Best Prop Firms of 2023 - Our Picks:

- The 5%ers - Most secure platform

FundedNext - Highest profit split

- Topstep - Best for Forex traders

- Fidelcrest - Best for experts

Trade The Pool - Best for trading stocks

The Trading Pit - Instant profit payouts

- FTMO - Best for instant funding

- Surgetrader - Best for trading various assets

- City Traders Imperium - Most thorough evaluation

Darwinex Zero - Best trading tool selection

Liberty Market Investment - Best prop firm for experienced traders

Funding Traders - Best customer support

SurgeTrader - Best for real-time analytics

TradersWithEdge - Best for asset variety

SabioTrade - Best for beginner traders

What Is Proprietary Trading?

Proprietary trading firms have etched a unique space within the financial tapestry. These entities diverge from the traditional financial institutions in their operational approach.

Instead of handling and investing clients' assets, they wield their own capital to speculate on financial markets and recruit professional traders to trade with the company's funds.

Their modus operandi is simple: profit from market movements directly, bypassing the commission-centric and more regulated model of standard brokerages.

Traders who pass the training or evaluation stages and get to trade with funded accounts are rewarded with a 50-90% profit split from their earnings, and in recent times some prop firms have also started awarding bonuses and monthly salaries to their best-performing traders.

Proprietary trading is speculative by nature, and comes with high risk, so there are strict rules and strategies that traders can follow and employ in order to manage this risk, including volatility arbitrage, global micro-trading, merger arbitrage and more.

Advantages of Prop Trading Firms

Prop trading bring a number of unique benefits to the table:

- Capital Empowerment: One of the standout benefits of prop trading firms is the access to substantial capital. This allows traders, even those with limited personal funds, to take on significant market positions, amplifying their profit potential.

- State-of-the-Art Technology: Prop firms are technology-driven entities, equipping traders with sophisticated analytical tools and modern trading platforms. The drive to edge out any sort of advantage is paramount, which is why more than two thirds of prop firms invest in consistent technological upgrades.

- Continuous Learning Environment: Proprietary firms are not just about trading; they're about nurturing talent. They offer comprehensive training modules, mentorship opportunities, and a culture that emphasizes continuous learning. Some 75% of traders note these training programs as instrumental to their success in the business.

- Access to Diverse Markets: Prop traders usually aren't limited to a specific market or instrument. Numerous proprietary trading firms provide traders with the opportunity to implement diverse strategies across an extensive array of financial markets. This includes foreign exchange (forex), futures contracts, commodities, precious metals, and the burgeoning realm of digital currencies. In fact, a recent study by Acuity has shown that 84% of prop firms are currently trading in crypto derivatives.

- Leverage and Liquidity: Prop firms provide traders with significant leverage, allowing them to maximize their market positions. Additionally, with their vast inventory of securities, traders can execute trades even in illiquid market conditions.

- Attractive Compensation Structures: The profit-sharing models in prop trading firms can be incredibly lucrative. Some have recently upped their game even further and are offering profit splits of up to 100% to their most successful traders, making this career possibly highly rewarding.

- Community and Collaboration: Given their closely-knit operational model, traders in prop firms often benefit from a sense of community, sharing insights, strategies, and collaborating for mutual success.

Disadvantages of Prop Trading Firms

While the allure of prop trading is undeniable, it's essential to understand the challenges and potential pitfalls:

- High Risk, High Pressure: The speculative nature of prop trading means there's a higher risk of significant losses. Combine this with the pressure to perform and show consistent profits, and it’s easy to see why proprietary trading is considered a highly stressful activity by many traders.

- Regulatory Hurdles: Post the 2008 financial crisis and the introduction of the Volcker rule, prop trading firms have come under increased regulatory scrutiny, with 50% of prop trading executives stating that regulation is among the biggest challenges that the industry is facing.

- Variable Income: Unlike traditional jobs with fixed salaries, prop traders earn based on performance. This can lead to income variability, making financial planning essential.

- Intellectual Property Concerns: Exceptional traders with unique strategies might face the risk of their strategies being replicated or reverse-engineered by the firm.

- Operational Costs: While prop firms provide access to advanced tools and platforms, they often come with associated costs. These operational expenses can eat into a trader's profits.

- Limited Diversification for Some Firms: While many prop firms allow diversification, some might specialize in specific markets or strategies, limiting a trader's flexibility.

- Intense Competition: The world of prop trading is fiercely competitive. Traders are constantly vying for the top spot, ironing out their strategies and using the newest automation tools and technical advantages, with the ever-evolving market dynamics ensuring that traders need to be on their toes at all times.

How to Become a Prop Trader

If you're contemplating a foray into the world of prop trading, here's an example of some of the important steps we’d recommend following:

- Gain Foundational Understanding: Before you can master the art of prop trading, it's essential to understand its basic tenets. While formal education in finance or economics can be a boon, it's not a strict necessity. What’s more important is the knowledge of various financial instruments and the systems and rules by which they operate.

- Master the Market: You can't just jump in and expect profits. If it were that simple, everyone would be a prop trader. Dedicate significant time to track market trends, understanding both technical and macroeconomic indicators.

- Familiarize Yourself With Regulatory Information: Every market operates within a framework of rules. Whether it's being aware of trading timings, understanding margins for futures and derivatives, or ensuring you don't trade on non-public material information, compliance is key. Familiarize yourself with relevant legislations and broker-specific rules to ensure you trade within legal and ethical boundaries, and avoid any prop firms which raise the red flags you need to look out for.

- Craft Your Trading Strategy: The world of prop trading is replete with indicators and strategies. For instance, if you're inclined towards the Simple Moving Average (SMA), you'll need to decide whether a 50-period SMA or a 100-period SMA aligns with your goals. Remember, no strategy guarantees consistent profitability. It's always prudent to complement technical indicators with other analytical tools to make well-rounded decisions.

- Learn Risk Management and Capital Preservation: In trading, there's no foolproof strategy. Considering the intrinsic risks, particularly when amplifying positions through leverage, it becomes essential to establish and adhere to stringent risk management measures. Tools like stop losses and hedging can be invaluable in mitigating potential losses.

- The Power of Practice: Before you're entrusted with a firm's capital, you'll likely be given a simulator account on a trading platform. This 'paper trading' phase is both a learning opportunity and a test of your trading acumen. It's a chance to familiarize yourself with platform features, refine strategies, and demonstrate your potential to prospective employers.

- Join a Prop Trading Program: Once you've honed your skills, consider enrolling in a prop trading evaluation program. Such programs assess your capabilities in real-world trading scenarios and can be a stepping stone to joining a reputable prop trading firm.

- The Transition to Live Trading: Successful completion of a prop evaluation program can lead to offers from trading partners, allowing you to trade with actual capital. This phase is where theory meets practice, or rubber meets the road, as they say.

For a more detailed explanation, you can check out our guide on becoming a prop trader.

How Much Do Prop Traders Make?

One of the most enticing aspects of prop trading is the potential for substantial earnings. While salaries vary based on performance and location, US prop traders earn an average yearly salary of $153,056, according to Glassdoor. The same source states that the highest salary for a prop trader in the United States is $209,637 per year.

How We Evaluate Prop Firms

The key to success with prop trading is finding the right prop firm to work with. Many companies are competing for new traders with advertised benefits and higher profit cuts. However, profit margins aren’t the only important criterion, and there are several factors to consider before committing to a specific firm.

Reputation

Due to the well-established presence of bad actors within the prop trading industry, a good reputation takes lots of work to build up. We’ve examined what users have to say about their experience on each platform and how the company handled any issues their traders faced.

Whether in a large or small organization, complaints that haven’t been clearly resolved are reflected in the company’s Trustpilot rating. The time it takes for the firm to onboard new traders and if it’s making on-time payments are some of the most important factors that reflect how reputable the company is.

Available Assets

What do you specialize in? Some prop firms have a variety of assets for trade, while others prefer to have traders focusing on a select few. You’ll likely have a choice of futures, stocks, forex, and other commodities.

Even though some are specifically designated, like forex prop firms for example, they can also include trading with cryptocurrencies and precious metals.

Fees & Subscription Costs

Fees and profit margins will be determining factors for any prospective trader on the hunt for a platform. You’ll have to make a financial commitment before being accepted as a regular trader and recieving prop firm funding, and some platforms have a higher barrier to entry than others.

The initial one-time fee for the evaluation process varies significantly; on the plus side, some companies do offer a refund for that payment.

Trading Platform and Trading Style

Check what trading platform the proprietary firm is using. When it comes to forex trading, the best prop firms implement MT4, MT5, and cTrader platforms, while others may emphasize technical analysis vs. fundamentals on which your potential investments are built.

Your approach to researching before making an investment may make or break your trading experience with some of the firms on this list.

Customer Support

Having a good support lifeline from the firm you are trading with is going to be essential. You may have important questions or issues to be resolved with your payments, profit splits, platform features, or just about anything else.

That’s where readily available support of a prop firm is incredibly helpful, and an extensive knowledge base will save you the precious time you need to dedicate to research and trading.

Further Reading:

FAQ

Is proprietary trading legal?

It depends on the person making the trades: In most situations, prop trading isn’t illegal, unless you are working for some of the most influential banks in the world. Due to the 2008 financial crisis, banks are no longer allowed to conduct proprietary trades.

Which prop firm is better than FTMO?

While FTMO is easily considered one of the leading platforms for prop trading, some alternatives are popular among traders. Some of these are Topstep, The 5%ers, FundedNext, and others that we listed here.

Are prop trading firms worth it?

Prop trading is a legitimate method of earning huge profits by making trades. Users who can make it through evaluation quickly get access to funded accounts and can start trading with the firm’s capital, which in some instances can amount to millions of dollars.

Do prop traders make money?

Yes, they do. Successful proprietary traders can expect to earn between $100,000 and $200,000 per year. Entry positions earn somewhat less, but most prop trading firms pay their traders competitively.

How do prop trading firms make money?

The main way prop trading firms earn money is by taking a percentage of each trader's profit, usually somewhere between 10% to 50%. There are also some companies which may charge for services like coaching and account opening.

Which prop firm is best for scalping?

We'd recommend looking at Topstep or FTMO if you're looking for a good prop firm for scalpers in 2023.

What are the best prop trading firms for futures?

The leading proprietary trading firms for futures trading in 2023 are The Trading Pit, FTMO and Topstep.

What is the most reliable forex prop firm?

If you're looking to trade with forex, we'd suggest one of the following prop firms:

- The5ers

- FX2 Funding

- FundedNext

- Fidelcrest

- SurgeTrader